See Uwazo in action

2-minute walkthrough of research, citations, and document analysis

Built for real workflows

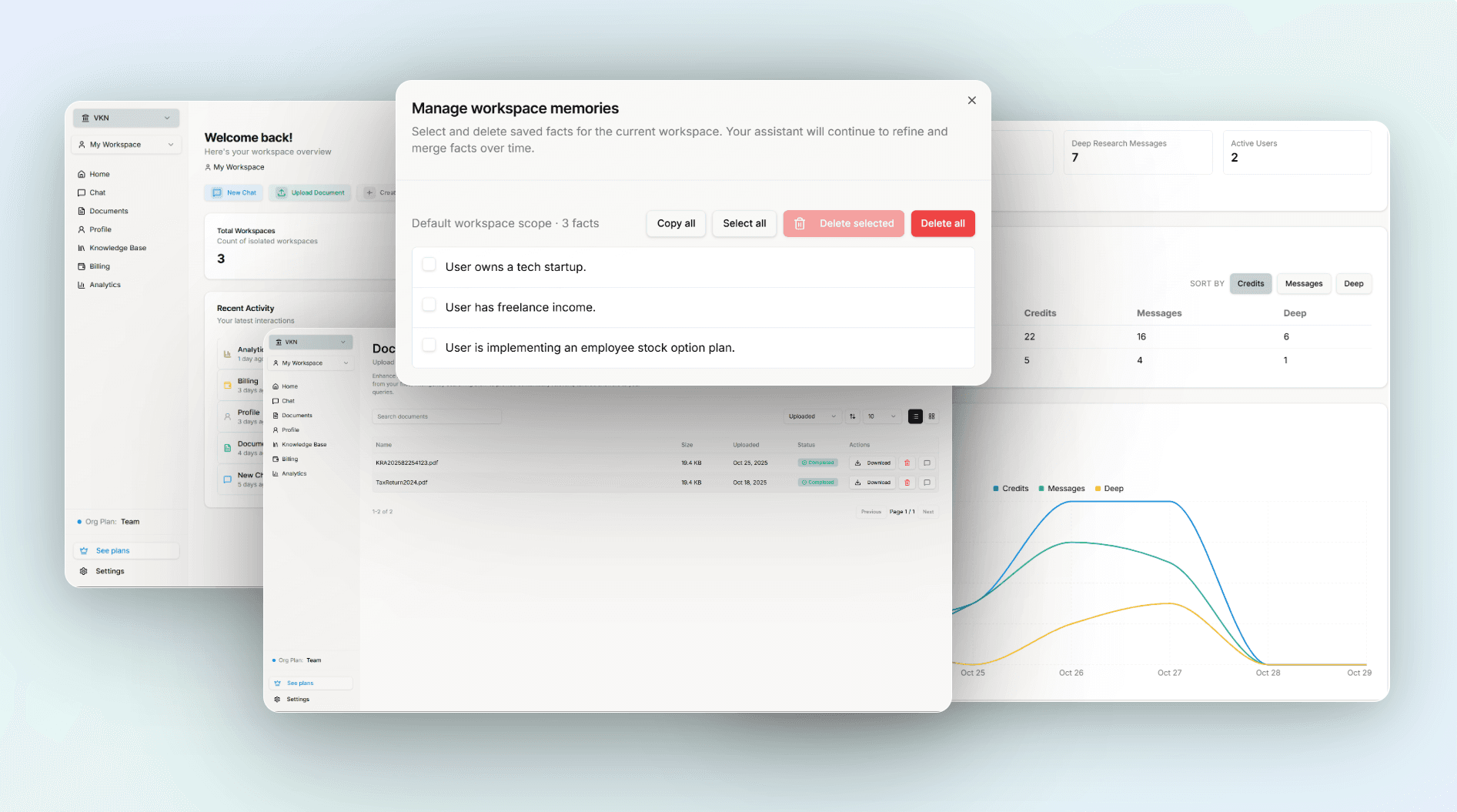

Workspace visibility

One place to track conversations, documents, and sources with clear status and citations.

Documents made actionable

Contracts, filings, and statements are indexed for extraction, cross-referencing, and drafting.

Institutional memory

Persist client context and decisions; reuse them across chats and teams.

Security & Privacy, by design

Enterprise-ready foundations: data sovereignty, granular access control, and auditable operations.

Data sovereignty

Bring your own data backend (your org-owned project) or self-host for maximum control. Your data stays within your boundary, with per-workspace private knowledge bases and strict isolation.

Access control

SSO support with advanced RBAC. Isolate workspaces, manage permissions by role, and protect sensitive matters end-to-end.

Compliance & audit

Audit logs, retention policies, and clear source citations. Trace how answers are formed and meet internal review standards.

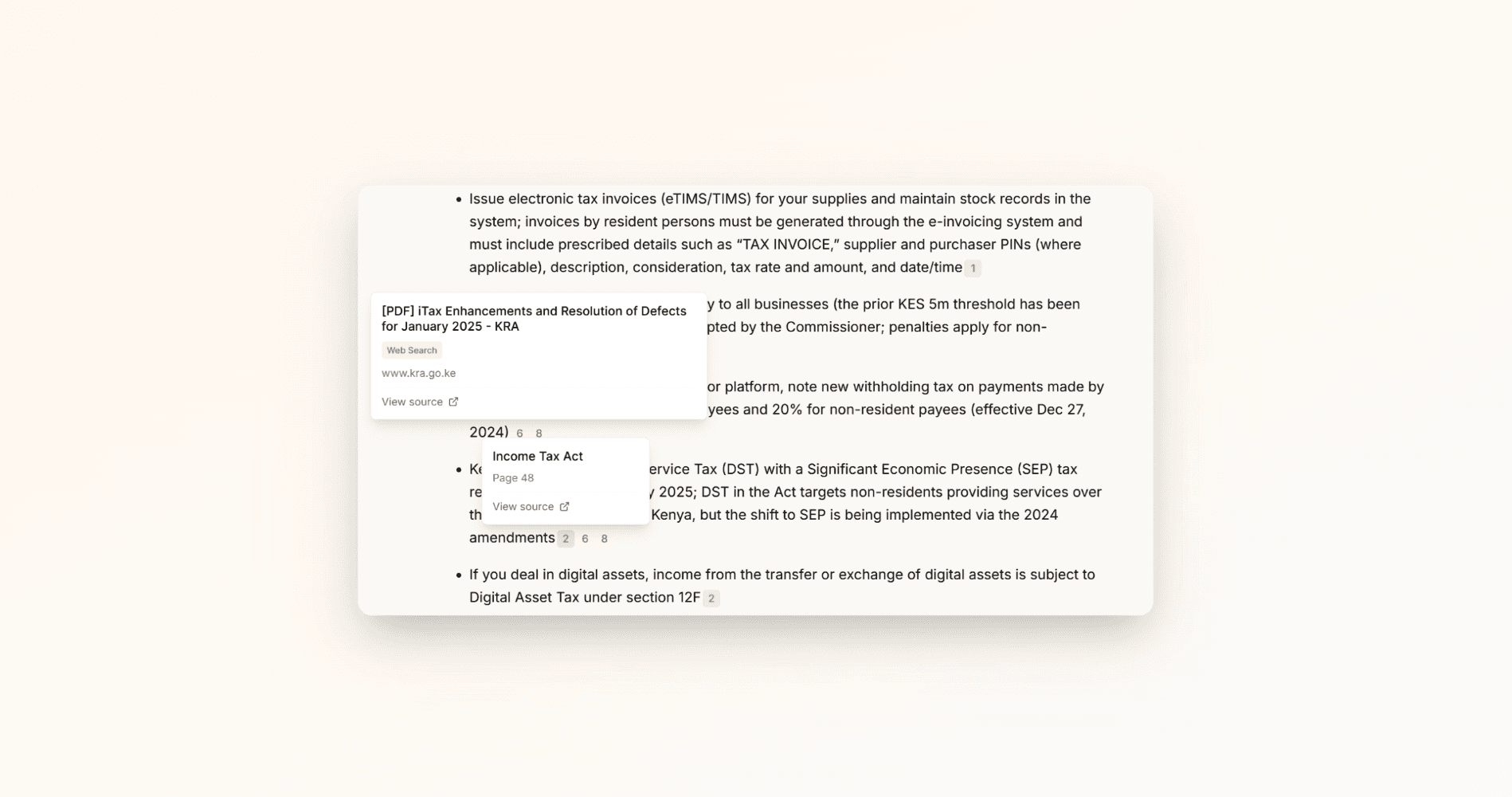

Ask complex questions. Get cited answers.

Grounded in Kenya's tax law, case law, and your own documents. Every output includes sources for auditability.

- Transparent citations

- Standard and deep research modes

- Agent plans, searches, and synthesizes across sources

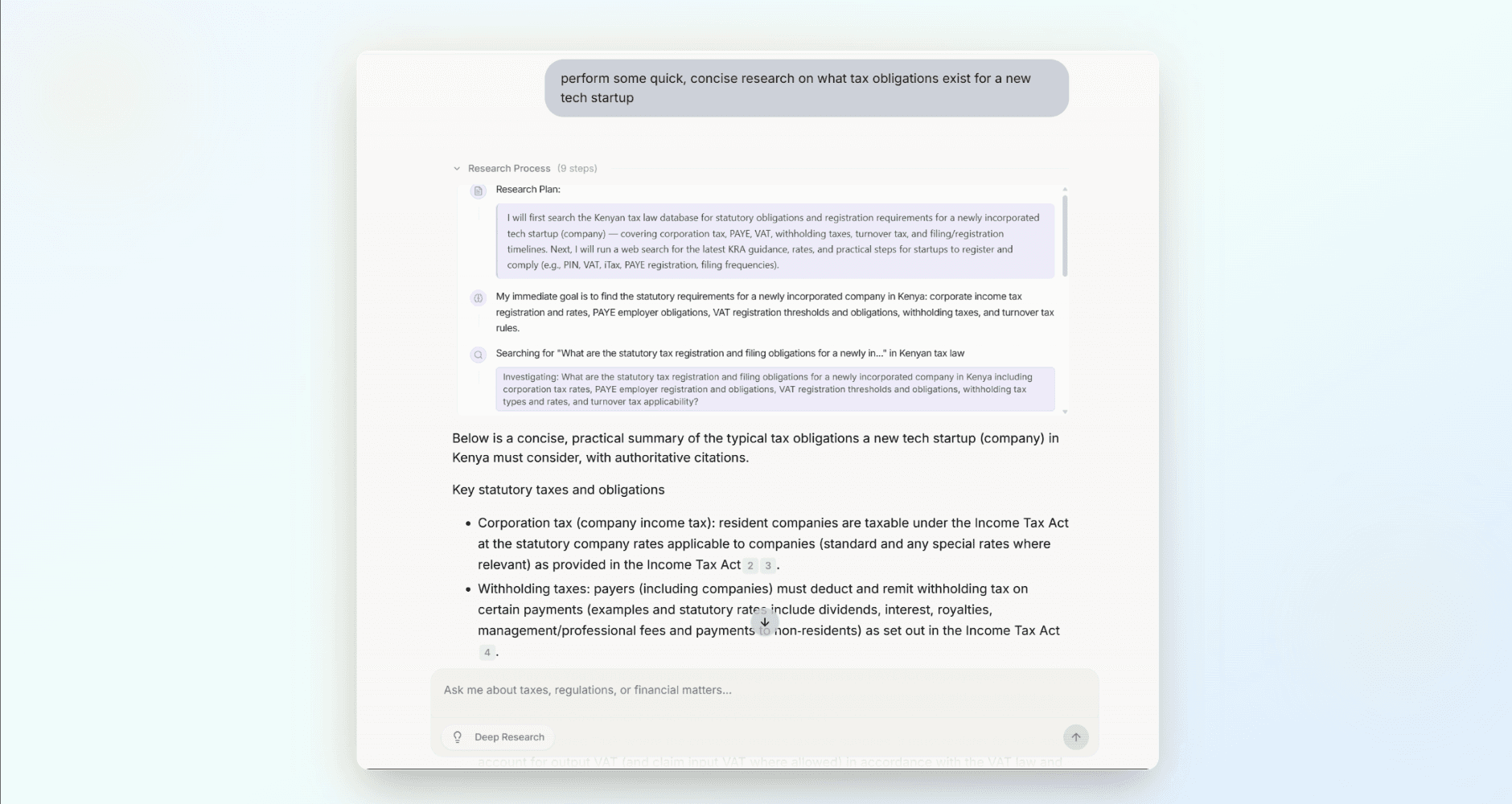

Plan, search, and synthesize automatically.

Deep Research uses a multi-step planner to query the web and Kenya's legal databases, reason over your private docs, and produce cited answers.

- Multi-step tool use with web and legal-DB search

- Reasons across external corpus + your private knowledge

- Streams progress and sources in real time

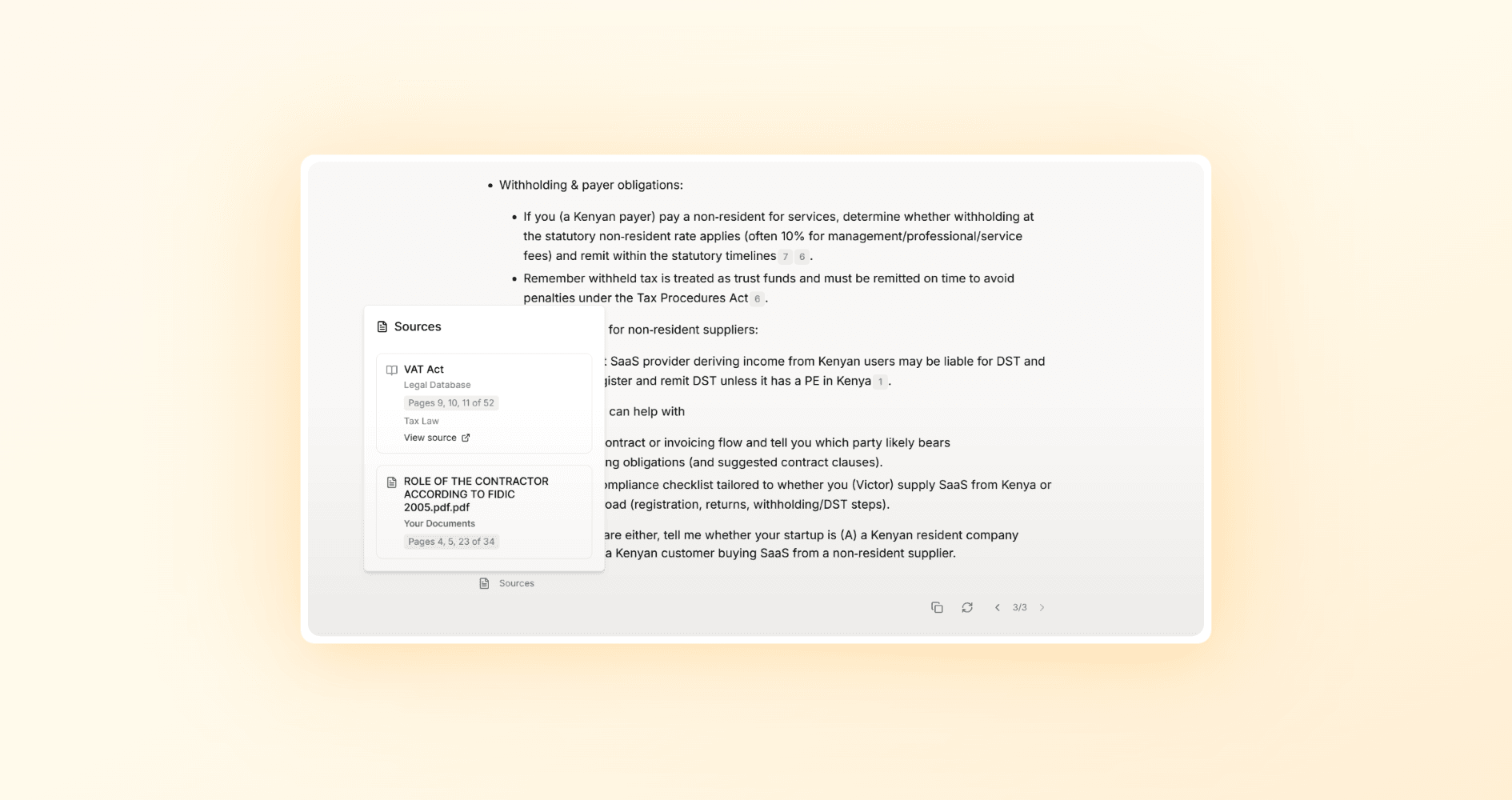

External + private knowledge, indexed by an agent.

Kenya's legal-financial corpus plus your private knowledge base. BYOB options for data sovereignty.

- Fast retrieval with source transparency

- Workspace isolation and fine-grained RBAC

- Self-hosted or dedicated cloud (BYOB)

AI-first knowledge for Kenya

External Kenyan corpus plus your private knowledge base. Indexed by an agent for fast, cited answers and document workflows.

External Kenyan knowledge base

Curated tax law, case law, and KRA directives. Answers grounded in local nuance with transparent citations.

Agentic document workflows

Upload contracts, filings, or statements. The agent indexes, cross‑references, and extracts risks, obligations, and opportunities. Turn hours of work into minutes.

Organization knowledge base

Author and maintain your internal knowledge shared across your org with RBAC. BYOB options for full data control.

Built for finance, accounting & legal teams

For companies, firms, and small businesses. Move faster, stay compliant, and advise with confidence.

From intake to opinion in one flow

A streamlined path for teams: diligence faster, advise smarter, and automate the repetitive.

Accelerate due diligence

- Analyze financials, contracts, and compliance in minutes

- Surface red flags and opportunities early

- Cited outputs for auditability

Supercharge strategic advisory

- Model tax implications in real time

- Draft client opinions backed by Kenyan law

- Move from reactive to predictive advice

Automate compliance & research

- Get sourced answers to complex regulatory questions

- Track changes and free time for higher-value work

- Seamless across tax, finance, and legal workflows

Early access pricing for ambitious teams

Start free. Upgrade when you're ready. Transparent, flexible, and built for velocity.

Starter

Pro

Teams

Enterprise

The future of your team starts here

Join a select group of visionary teams building a decisive advantage with AI — faster research, clearer decisions, stronger outcomes.

Uwazo enhances professional expertise with AI assistance. Final decisions and professional judgment remain with qualified practitioners.